THE INTELLIGENT VALUE LAYER

Mova is a next-generation blockchain engineered for high performance. Institutional-grade trust, and a versatile modular architecture—setting the new standard for compliant and scalable Web3 infrastructure.

The MOVA Ecosystem

Network Metrics

110,547

Transactions Processed

< 1.55

Finality

< 85%

On-Chain Development

< 70%

Latency

99.99%

Uptime

Powering the Future of Finance

High-Performance

Scalable architecture delivering 110k+ TPS with instant finality.

Institutional-Grade

Built-in compliance and custody designed for regulated finance.

Modular

Flexible components to rapidly build and customize financial applications.

Application Scenarios

With Mova, you connect directly to the global financial network — not in isolation. Our chain provides instant access to compliant stablecoins, RWA platforms, ICM protocols, and institutional liquidity. This opens the door for banks, payment providers, asset managers, and enterprises to bridge traditional finance with on-chain settlement, creating a unified infrastructure for the next era of payments and capital markets.

Stablecoins

Issue and settle compliant stablecoins with instant finality.

RWA Platforms

Tokenize and manage real-world assets under regulatory frameworks.

Internet Capital Markets

Connect capital markets to compliant DeFi rails with 24/7 settlement.

AI

Enable secure data sharing and AI-driven intelligence across networks.

Cross-Border Payments

Power low-cost global payments with real-time settlement.

Institutional Finance

Provide secure infrastructure for banks, funds, and financial institutions.

OUR TEAM

We are backed by a world-class core team spanning institutional finance, payments infrastructure, and top-tier blockchain engineering, supported by senior advisors in international legal & compliance, asset management, and private banking. With deep experience across L1 architecture, DeFi and trading infrastructure—plus real-world expertise in market operations, settlement, and regulatory engagement—we’re built to deliver at institutional standards. As the MOVA ecosystem scales, we will keep expanding through our investor and partner network, working alongside global pioneers to bring compliant payments and RWA settlement into real-world adoption.

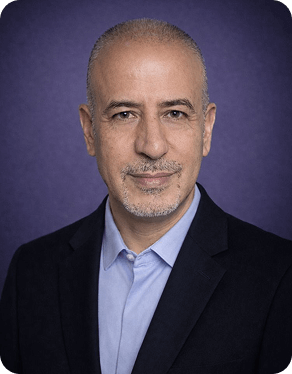

WAEL MUHAISEN

CEO

With 25+ years across financial markets, brokerage operations, and investment innovation, Wael has led institutions including ENBD and founded Al Ansari Financial Services and Trend Investment. He brings deep expertise in IPO structuring, regulatory compliance, and market infrastructure across ADX/DFM, guiding Mova’s strategy and institutional alignment.

LUCIAN

CTO

A senior technology developer since 2001 with 24 years spanning gaming, e-commerce, blockchain, consensus design, and AI, Lucian has architected large-scale, low-latency systems serving millions of concurrent users and 200M+ registered players. Since 2014, he has led blockchain architecture and custom consensus implementations (PoW/PoS/DPoS/PBFT/DAG), with hands-on delivery across DEX/CEX and scalable on-chain infrastructure.

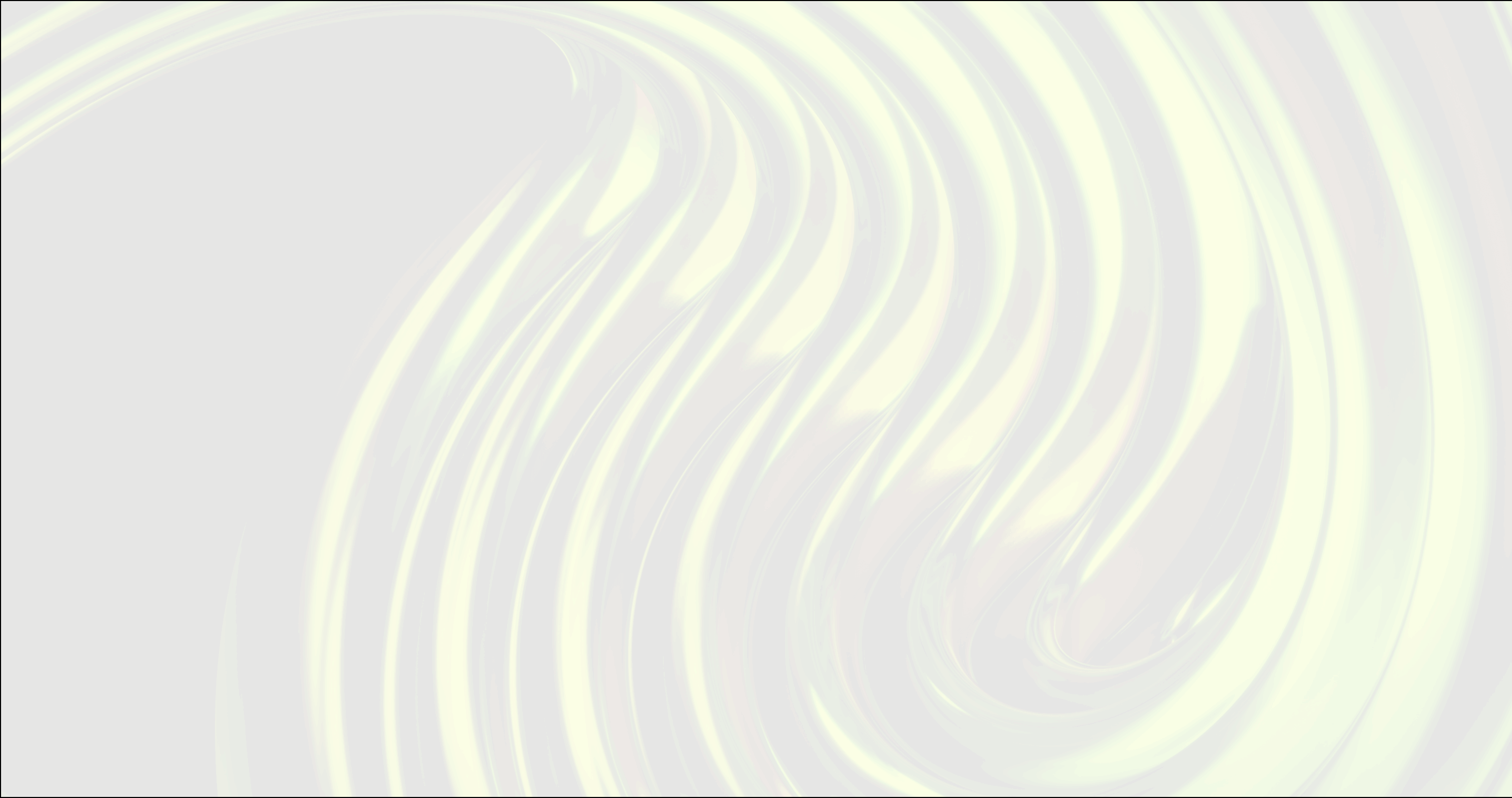

TINA ZHOU

Head of Development

Tina leads the architecture and delivery of scalable, secure, data-driven platforms across Web2 and Web3. She holds a Ph.D. in Computer Science (Vanderbilt) and degrees in Computer Engineering (Washington University in St. Louis), with expertise in AI/ML, optimization, and distributed systems for blockchain-integrated applications and smart contract infrastructure.

ADELINO DA SILVA

COO

Founder of GAA Labs and former partner at WUTINKUA Ghana, Adelino brings deep execution experience across Europe, Africa, MENA, and Lusophone markets. He specializes in Web3 operations, cross-border commerce, and government-level coordination to accelerate Mova’s global expansion.

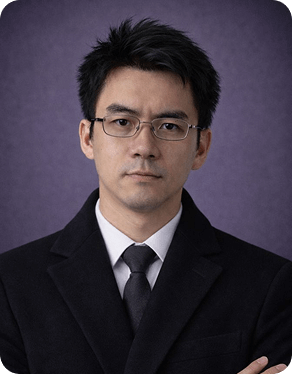

JERRY

CSO

With experience across Web3, financial engineering, and global markets — including contributions to Conflux, FLAME DAO, and PICWE — Jerry brings deep expertise in L1, DAO, and ecosystem growth architecture.

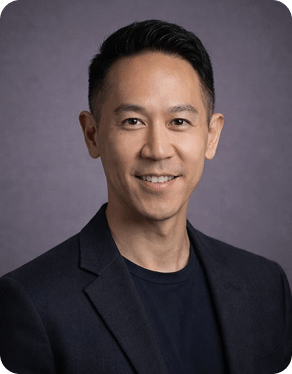

SIR ALAN KITCHIN

Board Advisor

Sir Alan Kitchin is a distinguished managing solicitor of the Supreme Court of England and Wales, with a legal foundation from the University of Cambridge. He has held senior positions at world-renowned firms such as Clifford Chance LLP and Ashurst LLP. Beyond his legal career, he serves as director and chairman across several organisations, including ReOx Ltd, a leading health-technology company in Oxford. His advisory expertise spans property investment and healthcare innovation, contributing deep governance and compliance oversight to Mova’s board.

JAMAL KHURSHID

Board Advisor

A recognised fintech and investment leader, Jamal served as Chairman of Jacobi Asset Management (Europe’s first spot Bitcoin ETF issuer) and founded Digital RFQ, a leading digital-asset trading and liquidity platform. He also sits on the boards of two Nasdaq-listed companies, strengthening Mova’s institutional market structure and strategy.

WALID TAWFIQ

Board Advisor

With 28+ years in private banking, wealth management, and financial services, Walid has held senior leadership roles across ADCB, Bank of Singapore, and ENBD. He brings deep UHNW and family office networks across MENA, supporting Mova’s institutional partnerships and growth.